Do you run your business from home? You might be eligible for home office deductions

If you’re self-employed and work out of an office in your home, you may be entitled to home office deductions. However, you must satisfy strict rules. If you qualify, you can deduct the “direct expenses” of the home office. This includes the costs of painting or repairing the home office and depreciation deductions for furniture […]

Rental real estate requires reporting for QBI deduction

There is a significant tax deduction available for owners of rental property, but you will have to get started now organizing your records to claim the savings on your 2019 taxes. The new qualified business income deduction that was created as part of the Tax Cuts and Jobs Act can be a great tax-saving tool […]

Antares Group named a Top 400 Accounting Firm by INSIDE Public Accounting

Antares Group, Inc., has been named as a Top 400 Accounting Firm for 2019 by INSIDE Public Accounting. This national ranking by the award-winning newsletter for the public accounting profession recognizes the country’s top accounting firms in terms of revenue and growth. Antares Group is a leading accounting firm with locations in Atlanta and Boston, […]

Tax-smart domestic travel: Combining business with pleasure

Summer is just around the corner, so you might be thinking about getting some vacation time. If you’re self-employed or a business owner, you have a golden opportunity to combine a business trip with a few extra days of vacation and offset some of the cost with a tax deduction. But be careful, or you […]

Three questions you may have after your tax return is filed

Tax season is now officially over, but once your 2018 tax return has been successfully filed with the IRS, you may still have some questions. Here are brief answers to three questions that we’re frequently asked at this time of year. Question #1: What tax records can I throw away now? This is a good […]

Don’t fall victim to one of the ‘Dirty Dozen’ tax schemes

Accountants are not the only ones working overtime during tax season. Scammers take advantage of this time of year to prey on taxpayers to try to steal their money and identity. The IRS has begun compiling its perennial “Dirty Dozen” list of the common scams that tend to peak during the tax filing months. As […]

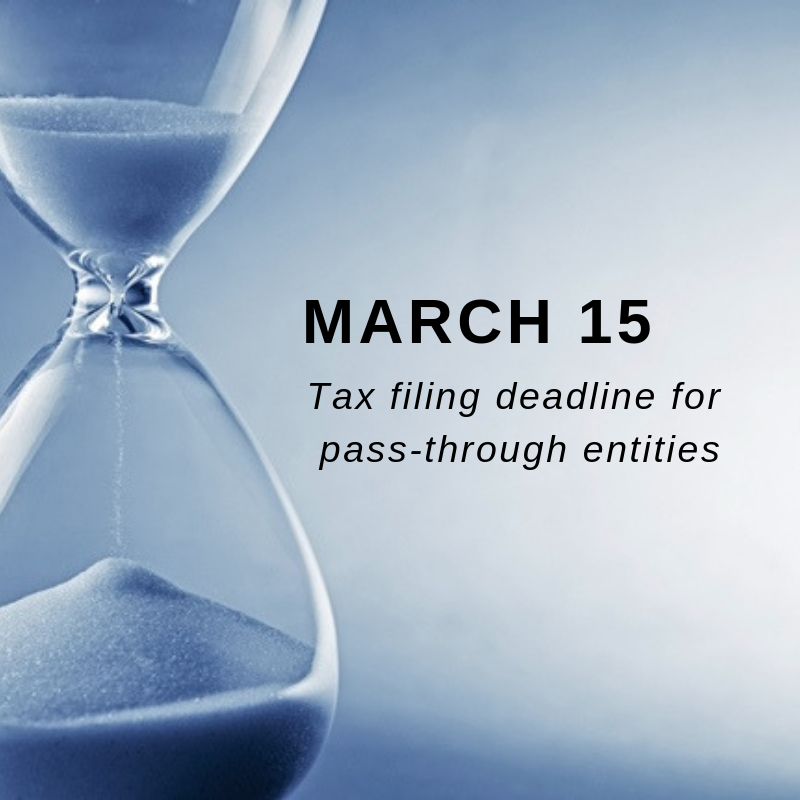

Beware the Ides of March — if you own a pass-through entity

Shakespeare’s words don’t apply just to Julius Caesar; they also apply to calendar-year partnerships, S corporations and limited liability companies (LLCs) treated as partnerships or S corporations for tax purposes. Why? The Ides of March, more commonly known as March 15, is the federal income tax filing deadline for these “pass-through” entities. Not-so-ancient history Until […]

Standard mileage rates to increase in 2019

The standard mileage rate for business travel is increasing in 2019 by more than 3 cents per mile. Beginning Jan. 1, 2019, the standard mileage rate for transportation or travel expenses is 58 cents per mile, up 3.5 cents from 2018 when it was 54.5 cents per mile. The Tax Cuts and Jobs Act suspended […]

Year-end tax and financial to-do list for individuals

With the dawn of 2019 on the near horizon, here’s a quick list of tax and financial to-dos you should address before 2018 ends: Check your FSA balance. If you have a Flexible Spending Account (FSA) for health care expenses, you need to incur qualifying expenses by December 31 to use up these funds or […]

Securely retain tax documents for future needs

“Out with the old, in with the new” can be good advice when shedding bad habits, but not necessarily the wisest course to take when retaining important records. Maintaining tax documents and other financial records is important when preparing to file taxes or an amended return, or in the case of an IRS audit. We […]