IRS to send letters in January about Child Tax Credit payments

Families who received advance Child Tax Credit payments in 2021 will need to file a 2021 tax return and compare the advance Child Tax Credit payments they received with the amount of the credit they can claim on their 2021 tax return. To help taxpayers reconcile the advance payments, the IRS is sending in January […]

Businesses with employees who receive tips may be eligible for a tax credit

If you’re an employer with a business where tipping is customary for providing food and beverages, you may qualify for a federal tax credit involving the Social Security and Medicare (FICA) taxes that you pay on your employees’ tip income. Basics of the credit The FICA credit applies with respect to tips that your employees […]

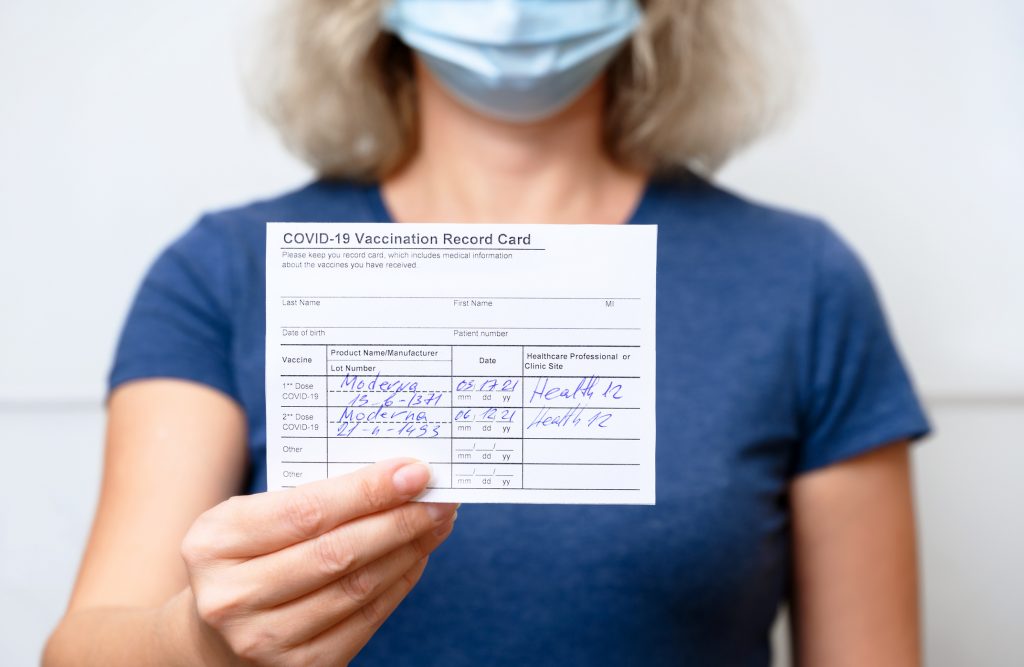

Supreme Court blocks vaccine mandate for large employers

The Supreme Court voted 6 to 3 to block the Biden administration’s federal vaccine mandate for employers with more than 100 employees. OSHA’s Emergency Temporary Standard (ETS) would have required workers to be vaccinated against the Covid-19 virus or to wear masks and be tested weekly. Employers were to have established policies to provide paid […]

Reforms may be on the way for Donor-Advised Funds

Donor-advised funds are a popular option to minimize capital gains tax, but a bill introduced this summer in the Senate could significantly impact these funds if it should be passed. The Accelerating Charitable Efforts (ACE) Act was introduced by Sens. Angus Kin of Maine and Chuck Grassley of Iowa in June. The ACE Act would […]

It’s personal now: Introducing Personal Bill Pay service

Antares Group is excited to announce a new service offering that can provide peace of mind for the busy professional or the entrepreneur who has sold their business and is now retired. Just like our Back Office Solutions services for businesses frees up our clients to focus on their business instead of on their bookkeeping […]

Aimee Gartner promoted to Marketing and Communications Director

Antares Group is pleased to announce the promotion of Aimee Gartner to Director of Marketing and Communications, effective October 1. Aimee joined Antares Group in November 2016 as the firm’s first Marketing and Communications Manager. Aimee graduated from the University of Georgia with a degree in Criminal Justice and a minor in French. She was […]

Rehiring retirees is now an option for addressing labor shortage

Nearly every business owner is feeling the pinch of the tight labor market but one option to consider is rehiring retirees or retain those employees who are past retirement age. Retaining long-term employees with a trusted track record and knowledge of your business can be a tremendous benefit, but this has not always been a […]

Did you get love mail from the IRS? Don’t panic!

Since March 2020, life has certainly changed for all of us and life at the Internal Revenue Service is no exception. With four tax legislative changes, the issuing of three separate rounds of stimulus checks, and out-of-date technology, who wouldn’t be a little behind? Unfortunately for taxpayers, this service lag can cause some big headaches. […]

Employers: Social Security wage base is increasing in 2022

The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $147,000 for 2022 (up from $142,800 for 2021). Wages and self-employment income above this threshold aren’t subject to Social Security tax. Background information The Federal Insurance Contributions Act (FICA) imposes two taxes on employers, employees and self-employed […]

Biden, House release revised Build Back Better framework, bill

President Biden released Thursday a framework to help guide the drafting of legislative language for the Build Back Better bill. What once contained $3.5 trillion in spending, the BBB now has been negotiated down to about $1.850 trillion dollars. The tax provisions included in the BBB framework include: Corporate minimum tax and stock buyback surcharge. […]