Here’s the skinny on fringe benefits and taxes

Do you offer a variety of fringe benefits to your employees? According to the IRS, these may include cars and flights on aircraft that the employer provides, free or discounted commercial flights, vacations, discounts on property or services, memberships in country clubs or other social clubs, and tickets to entertainment or sporting events. Simply put, according to […]

IRS to send letters in January about Child Tax Credit payments

Families who received advance Child Tax Credit payments in 2021 will need to file a 2021 tax return and compare the advance Child Tax Credit payments they received with the amount of the credit they can claim on their 2021 tax return. To help taxpayers reconcile the advance payments, the IRS is sending in January […]

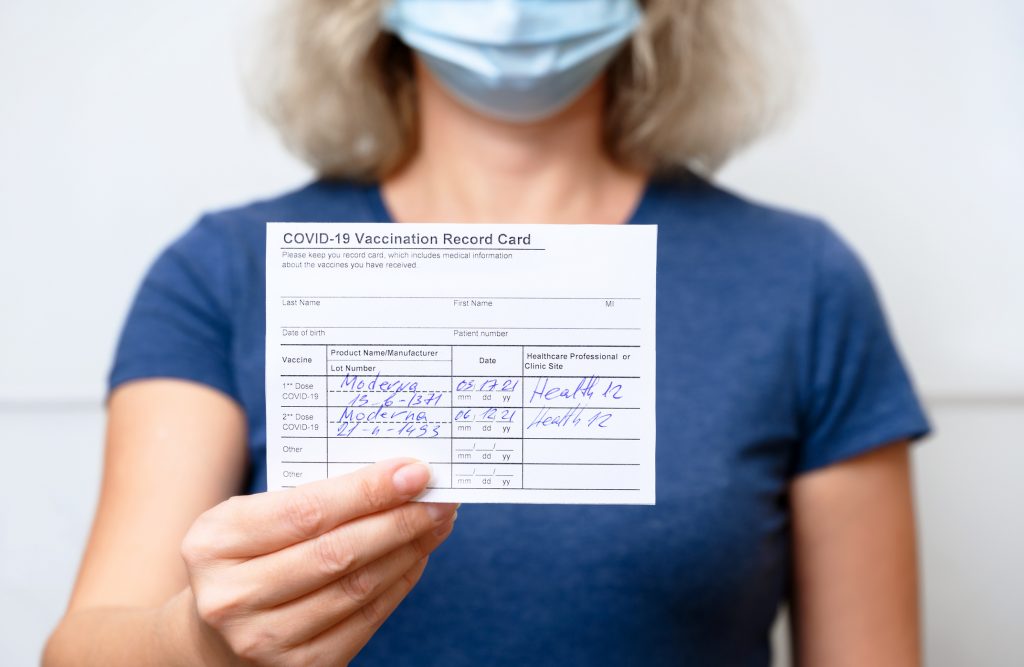

What employers need to know about ETS COVID testing and vaccination

OSHA has released its Emergency Temporary Standard (ETS) on COVID-19 vaccination and testing. While a federal court has issued a stay of these requirements in the midst of legal challenges, below is what is included in the regulations. All businesses with more than 100 employees – firm or company-wide – will be affected. Under the ETS, […]

Think outside the box to attract and retain employees

It is becoming harder and harder to attract and retain good employees. Turnover in restaurants is high but sometimes thinking outside the box and offering more benefits could help with retaining good employees. Many employers already offer the “basic benefits” to their full-time employees, which includes medical, dental, and vision insurance; 401(k) retirement plan; and […]

Employers eligible for tax credits for paid time off for Covid vaccine

Employers can now apply for tax credits for wages paid to employees who help family members who obtain a COVID-19 vaccination. Credits were made available to employers through the American Rescue Plan Act of 2021 (ARPA) for qualified wages paid to employees who took leave as a result of the coronavirus. According to updated guidance […]

COBRA subsidy details: Notification deadline approaching

As part of the American Rescue Plan Act signed into law in March, employers can receive a 100% subsidy for extended COBRA coverage for employees who were terminated or who lost coverage because their hours were involuntarily reduced or they were involuntarily terminated, making them eligible for COBRA. While employers must bear the cost of […]

Restaurant Revitalization Grants ready to roll soon

The Small Business Administration has announced that registrations for the $28.6 billion Restaurant Revitalization Fund grants will open at 9 a.m. EST Friday, April 30, with the application officially open at noon EST Monday, May 3. The online application will remain open to any eligible establishment until all funds are exhausted. If you plan to […]

More guidance issued on Massachusetts sales and meals tax changes

We advised you a couple months ago that beginning April 1, Massachusetts had enacted accelerated remittance of sales and meals tax. Few details were available at that time, but the state has recently updated its guidance so we wanted to provide you more information. According to the state, businesses that had $150,000 or more in sales […]

More flexibility offered for employee FSA plans

Employees with flexible spending arrangements, or FSA, for health care or dependent care expenses now have a more flexibility to use these benefits. As you know, employers can offer employees FSAs to use throughout a plan year either for medical expenses or for dependent care expenses. Most FSAs contain a “use it or lose it” […]

How does the American Rescue Plan impact individual taxpayers?

The latest Covid-relief bill – the $1.9 trillion American Rescue Plan Act of 2021 (ARPA) – was signed into law by President Biden, and it provides several provisions specifically beneficial to restaurant owners and to small business owners and individuals in general. Much of the ARPA extends and expands on the provisions from earlier Covid-relief […]