Take advantage of a “stepped-up basis” when you inherit property

If you’re planning your estate, or you’ve recently inherited assets, you may be unsure of the “cost” (or “basis”) for tax purposes. Fair market value rules Under the fair market value basis rules (also known as the “step-up and step-down” rules), an heir receives a basis in inherited property equal to its date-of-death value. So, […]

What’s next for Emergency Sick Leave now that school is out for summer?

In the early days of the COVID-19 pandemic, Congress passed the Families First Coronavirus Response Act that, in part, provides emergency sick leave and expanded family and medical leave for employees who need to care for children whose schools had been closed as a result of the virus. Now that the school year is ending […]

Coronavirus and Economic Impact Payments FAQs from IRS

Click below for a list of frequently asked questions regarding coronavirus-related economic impact payments and other resources from the IRS.gov website: https://www.irs.gov/coronavirus/coronavirus-and-economic-impact-payments-resources-and-guidance

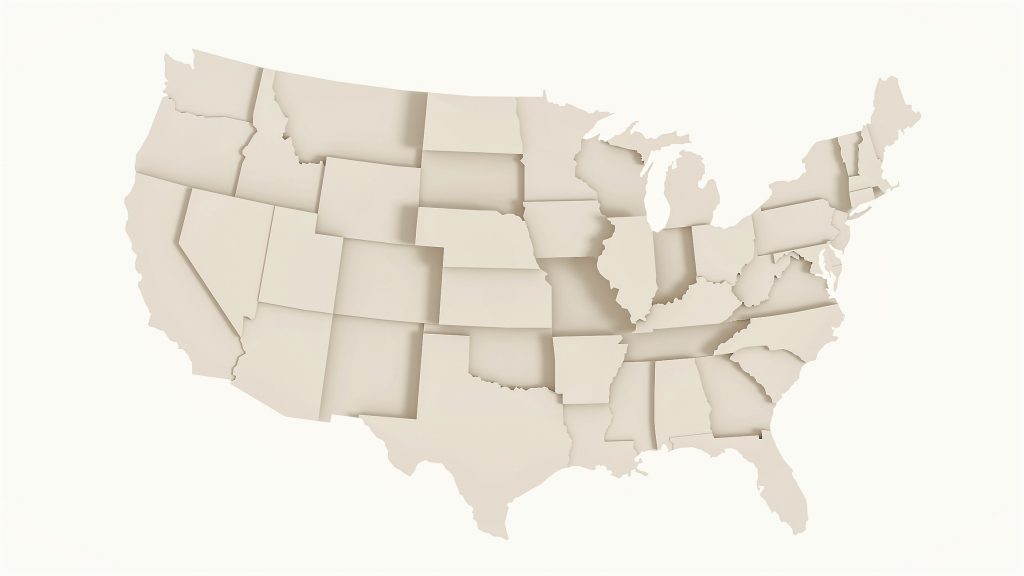

States offer tax filing relief in wake of COVID-19 outbreak

As the impact of the coronavirus (COVID-19) continues to spread across the country, different states’ departments of revenue are offering various forms of tax relief, from extending tax filing deadlines to deferring sales tax. Legislative activity is moving quickly and changing daily. As of March 23, 2020, 39 states, along with various municipalities, have issued […]

April 15 tax payment deadline extended

Treasury Secretary Steven Mnuchin announced that individuals can defer tax payments up to $1 million and corporations can defer tax payments up to $10 million for 90 days. The $1 million limit for individuals was established to cover small businesses and pass-through entities. The payment deadline extension is in response to the COVID-19 outbreak. At the time […]

Antares Group to close offices until April 1 amid COVID-19 outbreak

The spread and impact of COVID-19 is wide-reaching and evolving daily. We are continuing to monitor the developments of the outbreak and how this affects our clients and our staff. We are taking the appropriate steps, as recommended by the CDC and WHO, to support the ongoing health and safety of our employees, their families, our clients and the surrounding communities. […]

Do you run your business from home? You might be eligible for home office deductions

If you’re self-employed and work out of an office in your home, you may be entitled to home office deductions. However, you must satisfy strict rules. If you qualify, you can deduct the “direct expenses” of the home office. This includes the costs of painting or repairing the home office and depreciation deductions for furniture […]

IRS Tax Tip: Common errors taxpayers should avoid

Filing a tax return electronically reduces errors because the tax software does the math, flags common errors and prompts taxpayers for missing information. Using a reputable tax preparer – including certified public accountants, enrolled agents or other knowledgeable tax professionals – can also help avoid errors. Mistakes can result in a processing delay, which can mean it takes more […]

Antares Group donates Thanksgiving meals to families at Phoenix Pass

Antares Group continues its annual tradition of providing Thanksgiving meals for the families living at Phoenix Pass. Each year, our associates donate money and food items for the women and children living at Phoenix Pass. This year, Antares Group provided turkeys, stuffing, vegetables, dessert, and other items for 15 mothers and 35 children. The meals […]

Employers to submit detailed pay data to EEOC

Employers will have until the end of September to submit more detailed pay data to the Equal Employment Opportunity Commission. Employers with 100 or more employees were already required to submit pay data – Component 1 data – to the EEOC by May 31. The Component 1 data breaks down the number of workers employed […]