4 best practices for accounting for tips in your restaurant business

In the restaurant industry, many employees rely on tips as the primary source of their income. As with all wages, it is important for restaurants to ensure that tips are properly managed and reported. Since tipped income functions differently from a traditional paycheck, it can often be confusing to know exactly how such income should […]

IRS to send letters in January about Child Tax Credit payments

Families who received advance Child Tax Credit payments in 2021 will need to file a 2021 tax return and compare the advance Child Tax Credit payments they received with the amount of the credit they can claim on their 2021 tax return. To help taxpayers reconcile the advance payments, the IRS is sending in January […]

Businesses with employees who receive tips may be eligible for a tax credit

If you’re an employer with a business where tipping is customary for providing food and beverages, you may qualify for a federal tax credit involving the Social Security and Medicare (FICA) taxes that you pay on your employees’ tip income. Basics of the credit The FICA credit applies with respect to tips that your employees […]

Supreme Court blocks vaccine mandate for large employers

The Supreme Court voted 6 to 3 to block the Biden administration’s federal vaccine mandate for employers with more than 100 employees. OSHA’s Emergency Temporary Standard (ETS) would have required workers to be vaccinated against the Covid-19 virus or to wear masks and be tested weekly. Employers were to have established policies to provide paid […]

Reforms may be on the way for Donor-Advised Funds

Donor-advised funds are a popular option to minimize capital gains tax, but a bill introduced this summer in the Senate could significantly impact these funds if it should be passed. The Accelerating Charitable Efforts (ACE) Act was introduced by Sens. Angus Kin of Maine and Chuck Grassley of Iowa in June. The ACE Act would […]

Don’t let sales tax on food delivery sales eat into your bottom line

Delivery is a key segment of food sales that restaurant owners need to watch carefully. Between the number of different delivery companies entering the market and marketplace rules, restaurant owners need to be careful that they are keeping track of who is remitting sales tax on delivery sales each month. The best way for restaurant […]

Think outside the box to attract and retain employees

It is becoming harder and harder to attract and retain good employees. Turnover in restaurants is high but sometimes thinking outside the box and offering more benefits could help with retaining good employees. Many employers already offer the “basic benefits” to their full-time employees, which includes medical, dental, and vision insurance; 401(k) retirement plan; and […]

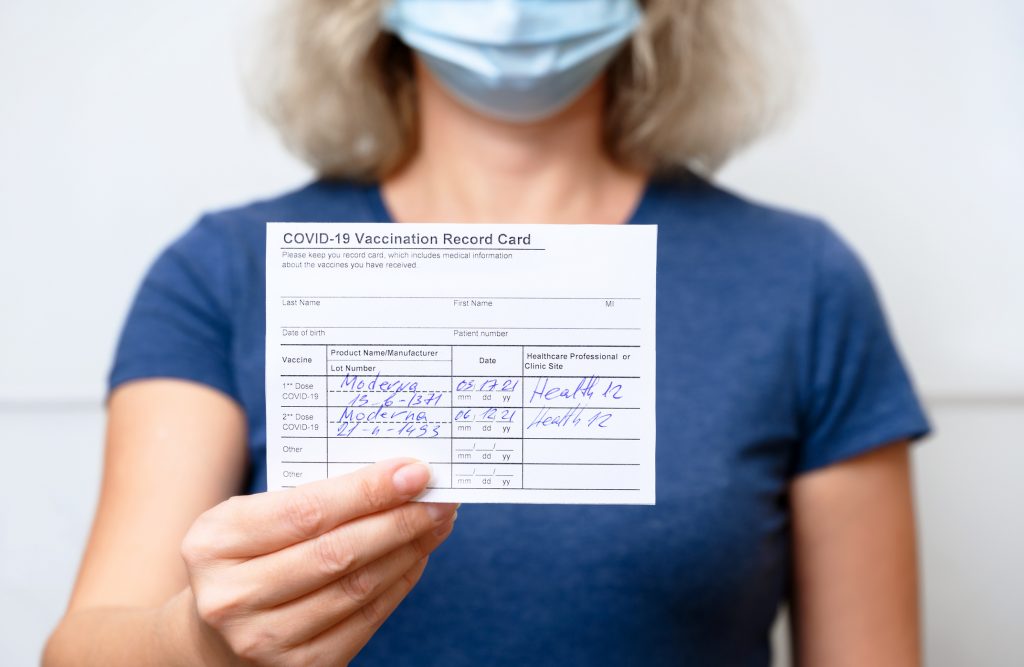

Employers eligible for tax credits for paid time off for Covid vaccine

Employers can now apply for tax credits for wages paid to employees who help family members who obtain a COVID-19 vaccination. Credits were made available to employers through the American Rescue Plan Act of 2021 (ARPA) for qualified wages paid to employees who took leave as a result of the coronavirus. According to updated guidance […]

Patience is in order if awaiting tax refund this year

If you are expecting a tax refund this year, you may have to wait a bit longer than usual. Between staff shortages, a backlog of returns from the 2020 filing season, processing Recovery Rebate Credits, validating income for the Earned Income Tax Credit and Additional Child Tax Credit – not to mention applying changes in […]

COBRA subsidy details: Notification deadline approaching

As part of the American Rescue Plan Act signed into law in March, employers can receive a 100% subsidy for extended COBRA coverage for employees who were terminated or who lost coverage because their hours were involuntarily reduced or they were involuntarily terminated, making them eligible for COBRA. While employers must bear the cost of […]