Steer clear of the Trust Fund Recovery Penalty

If you own or manage a business with employees, you may be at risk for a severe tax penalty. It’s called the “Trust Fund Recovery Penalty” because it applies to the Social Security and income taxes required to be withheld by a business from its employees’ wages. Because the taxes are considered property of the […]

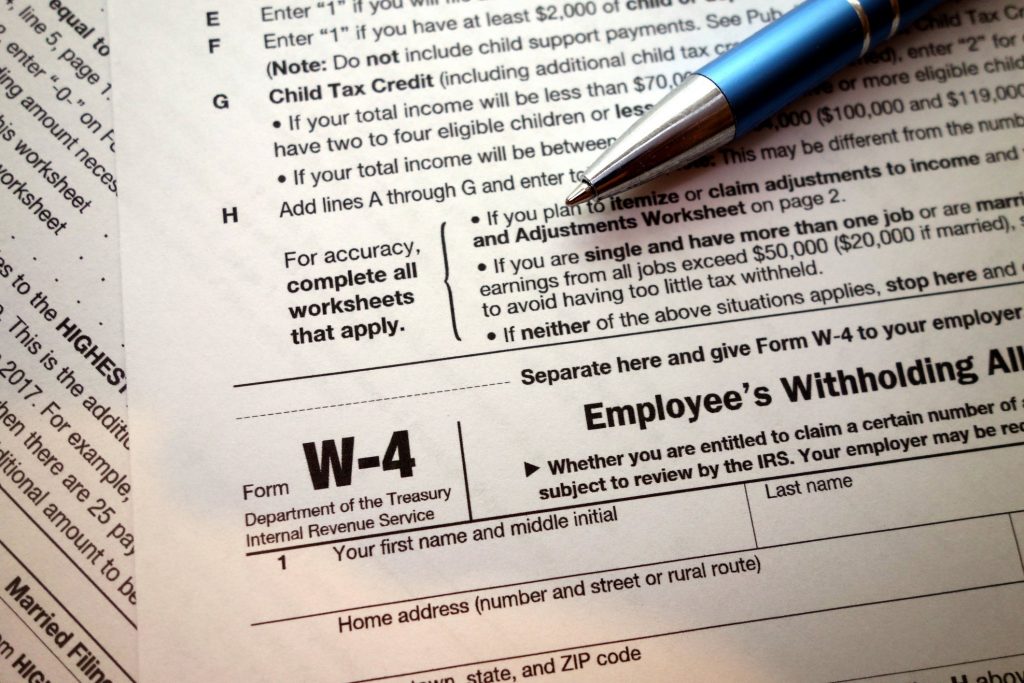

Pay too little in taxes last year? IRS offers relief for underpayment

Many taxpayers saw a bump in their take-home pay last year as a result of the lower tax rates and increased standard deduction thanks to the Tax Cuts and Jobs Act. That’s the good news. On the other hand, some taxpayers may have had too little tax withheld in 2018, exposing them to potential penalties […]

Employers to face excise tax if not in compliance with ACA

Employers could be receiving notices before the end of the year that they will be fined for not providing minimum essential healthcare coverage to employees under the Affordable Care Act. Applicable large employers may be subject to the excise tax if they do not offer minimum essential coverage to at least 95 percent (70 percent […]