What’s next for Emergency Sick Leave now that school is out for summer?

In the early days of the COVID-19 pandemic, Congress passed the Families First Coronavirus Response Act that, in part, provides emergency sick leave and expanded family and medical leave for employees who need to care for children whose schools had been closed as a result of the virus. Now that the school year is ending […]

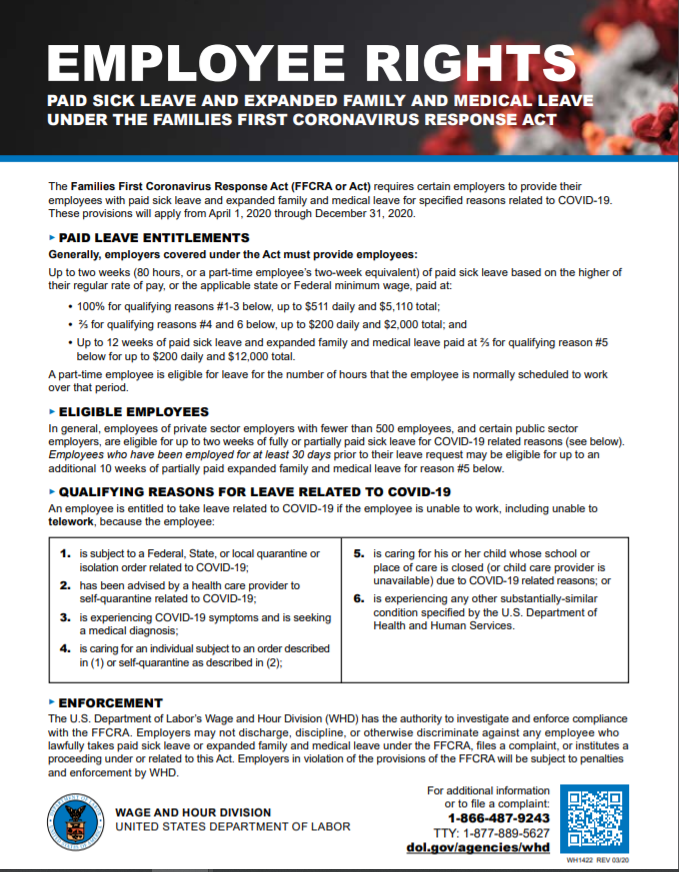

A deeper dive into the Families First Coronavirus Response Act

More details have emerged about the Families First Coronavirus Response Act (FFCRA) and how employers need to file for credits related to paying qualified sick and family leave wages or qualified wages. As you know, the FFCRA requires businesses with fewer than 500 employees to provide emergency paid sick and family leave for reasons related […]

Department of Labor resources for FFCRA

The Families First Coronavirus Response Act (FFCRA) provides for emergency sick leave and emergency expansion to the Family and Medical Leave Act. Guidance on this law, as well as the Coronavirus Aid, Relief and Economic Security (CARES) Act continues to evolve. Below are some resources for employers from the U.S. Department of Labor: Click here […]

Families First Coronavirus Response Act provides paid sick and family leave, employer tax credits

President Trump signed today the Families First Coronavirus Response Act (H.R. 6201) to provide affected individuals with paid sick and family leave and create tax credits for affected employers, expand food and nutrition services, allow for emergency state unemployment insurance grants, and increase Medicaid funding to states, among other things. The leave provisions go into […]